Urban Company (formerly UrbanClap), India’s largest home services platform, is set to launch a ₹1,900 crore IPO, marking a milestone for the gig economy. With operations in 59 cities across India, UAE, Singapore, and the U.S., the company reported a turnaround profit of ₹242 crore in 9M-FY24 after years of losses. This guide delves into its asset-light marketplace model, 46,000+ service partners, and how it plans to use IPO proceeds for AI upgrades and global expansion—key insights for investors eyeing this tech-driven disruptor.

Urban Company IPO: Complete Investor’s Guide

1. IPO Key Details

₹1,900 Cr

Total Issue Size

₹429 Cr

Fresh Issue

₹1,471 Cr

Offer for Sale (OFS)

Use of Proceeds:

- ₹190 crore for AI/tech upgrades

- ₹70 crore for global expansion

- ₹80 crore for brand marketing

- Balance for working capital

2. Business Model

Customer books service via app

AI matches with verified partner

Service completed with quality check

Revenue Streams:

- Commission (20-30% per booking)

- Subscription plans (UC Plus)

- Product sales (RO purifiers, etc.)

3. Financial Performance

FY2024

9M-FY2025

| Metric | FY2023 | FY2024 | 9M-FY2025 |

|---|---|---|---|

| Revenue (₹ cr) | 637 | 827 | 846 |

| Profit/Loss (₹ cr) | -312 | -93 | 242 |

| Active Partners | 42,000+ | 46,000+ | 50,000+ |

4. Service Coverage

India (50+ cities)

- Delhi NCR

- Mumbai

- Bangalore

- Hyderabad

- Pune

- Chennai

- Kolkata

- Jaipur

- Ahmedabad

International

- Dubai, UAE

- Abu Dhabi, UAE

- Riyadh, Saudi Arabia

- Jeddah, Saudi Arabia

- Singapore

5. Service Categories

Home Repair

- Plumbing

- Electrical

- Carpentry

- AC Service

Beauty

- Salon-at-home

- Massage

- Skincare

Cleaning

- Deep cleaning

- Pest control

- Disinfection

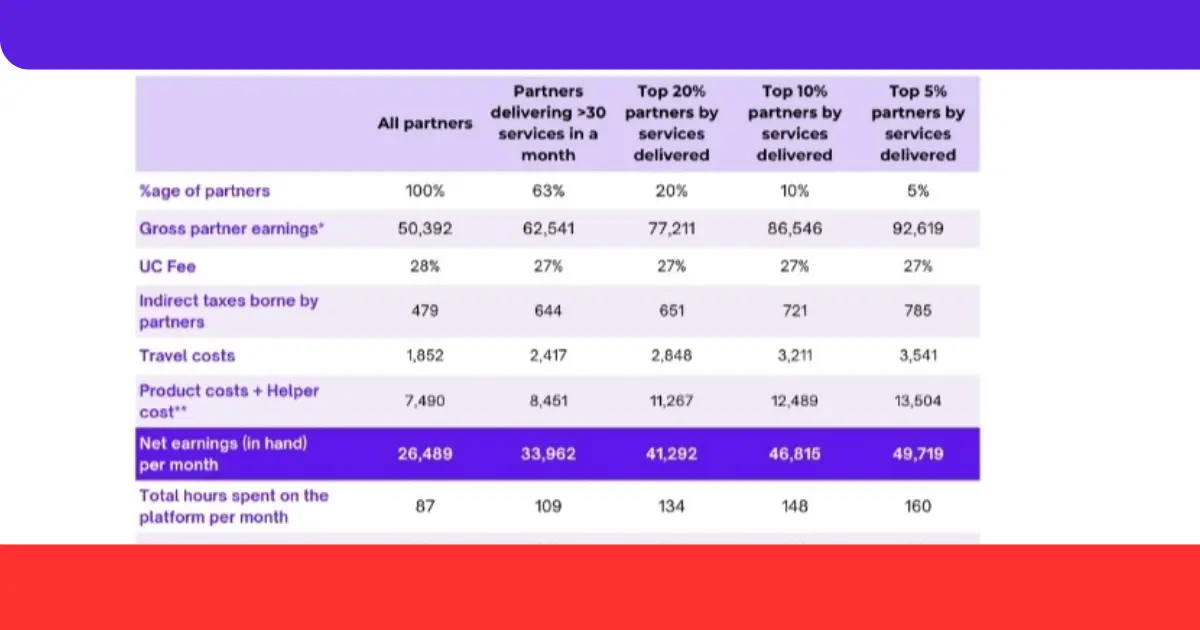

6. Partner Program

Apply with skill proof

Clear background check

Complete training

Start earning

₹25K-40K

Avg. monthly earnings

20-30%

Commission per booking

1L+

Top partners earn

7. Risks & Challenges

Regulatory Changes

New gig-worker laws may increase costs

Seasonal Impact

22% revenue dip during monsoons

Competition

Housejoy, NoBroker in domestic market