The share market often appears as a complex maze, governed by charts, news, and financial reports. While technical and fundamental analysis forms the bedrock of investing, there are often subtle, yet powerful, dynamics at play – the unwritten rules of share market. These are the operational realities and psychological nuances that aren’t explicitly taught in textbooks but dictate market behavior and can significantly impact a retail investor’s journey.

This article aims to uncover these unwritten rules of share market, providing practical insights for Indian investors. We will explore why certain stocks hit circuit filters, how the activities of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) influence the market, and delve into effective strategies for setting stop-loss in intraday trading. Understanding these hidden dynamics, often considered stock market hidden rules, is crucial for navigating the market with greater confidence and intelligence.

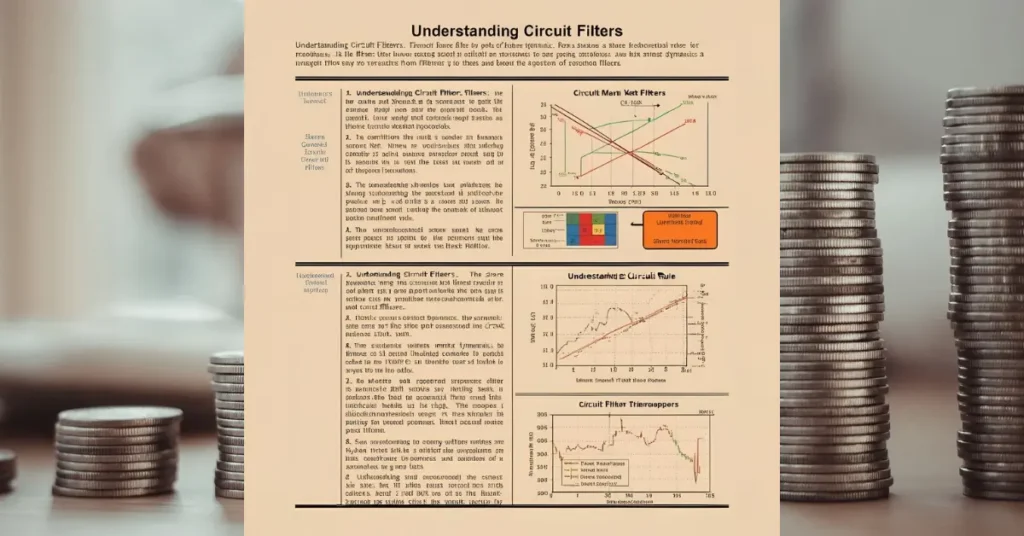

Understanding Circuit Filters: An Unwritten Rule of Share Market Dynamics

Circuit filters are mechanisms imposed by stock exchanges (like NSE and BSE in India) to prevent excessive volatility in a stock’s price during a trading day. These limits are typically set at 2%, 5%, 10%, or 20% of the previous day’s closing price. When a stock hits its upper or lower circuit, trading in that stock is temporarily halted. But what are the unwritten rules of share market that cause this sudden halt?

The primary reason is an extreme imbalance between demand and supply. This often stems from sudden major news. For upper circuits (stock price hitting its daily maximum), positive news like excellent earnings reports, major merger/acquisition announcements, new government contracts, product launches, positive regulatory announcements, or large block purchases by institutional investors (FIIs/DIIs) can be the trigger. Conversely, for lower circuits (stock price hitting its daily minimum), negative news such as poor quarterly results, fraud allegations, large promoter stake sales, adverse regulatory actions, or bankruptcy declarations can cause a rapid decline.

Extreme investor sentiment, like FOMO (Fear Of Missing Out) or panic selling, also plays a significant role, especially in less liquid stocks (small-cap, penny stocks) where even a relatively small order can disproportionately affect price. Additionally, bulk/block deals by large investors can create sudden shifts in demand or supply. Rumors or unconfirmed news, particularly for smaller-cap stocks, can lead to sudden price movements, violating the unwritten rules of share market stability. Even technical breakouts or breakdowns, where a stock breaches significant technical levels, can trigger a cascade of orders from algorithmic trading and momentum traders, revealing some of the stock market hidden rules.

The purpose of circuit breakers is to curb excessive volatility, prevent investors from making impulsive, emotional decisions, and maintain orderly trading. For a new investor, understanding these is a vital unwritten rule of share market safety.

FII/DII Activities: A Major Unwritten Rule of Share Market Influence

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) collectively represent “smart money” due to their large capital deployment and professional research capabilities. Their buying and selling patterns are closely watched by retail investors, as they often signal underlying market trends. Understanding their influence is a key unwritten rule of share market insight, part of the broader stock market hidden rules.

Who are they?

- FIIs (Foreign Institutional Investors): These are overseas entities like pension funds, hedge funds, and sovereign wealth funds. Their decisions are influenced by global economic trends, interest rates in their home countries, and geopolitical events, impacting their allocation to emerging markets like India.

- DIIs (Domestic Institutional Investors): These include Indian mutual funds, insurance companies, and domestic pension funds. They tend to focus more on Indian economic trends, domestic liquidity, and long-term investment goals.

Their Impact:

- Market Direction: FIIs and DIIs invest enormous amounts of capital, so their collective buy/sell decisions can significantly influence the overall market direction (trend). Strong FII buying often correlates with market rallies, while sustained selling can lead to corrections.

- Market Stability: DIIs often act as a counter-balancing force during FII sell-offs, absorbing liquidity and providing stability to the market. In India, the growing influence of DIIs has helped moderate volatility caused by FII outflows, a crucial unwritten rule of share market resilience.

- Influence on Retail Investors (as an indicator): FIIs’ strong buying can signal global confidence in the Indian economy (e.g., economic recovery or strong GDP growth), which retail investors might interpret as a bullish sign. Conversely, if FIIs are selling due to global uncertainty but DIIs are actively buying, it could indicate that the downturn might be temporary and there’s no need for panic. Observing where FIIs and DIIs are deploying capital can offer valuable insights, as they are often considered “smart money.”

Caution: Retail investors should avoid blindly mimicking FII/DII activities. Their investment strategies, risk appetites, and time horizons differ vastly from those of individual investors. Focus on your own research and long-term financial goals, a timeless unwritten rule of share market success.

Intraday Stop-Loss: A Non-Negotiable Unwritten Rule of Share Market Trading

While not strictly “unwritten” in theory, the practical application and discipline of setting stop-loss in intraday trading often become an unwritten rule of share market survival. A stop-loss order is an essential tool to limit potential losses and protect capital, especially in the fast-paced intraday environment. Understanding these tactics is part of grasping the stock market hidden rules.

Effective Ways to Set Stop-Loss in Intraday Trading:

- Percentage Rule: This is one of the most common and disciplined approaches. You pre-determine the maximum percentage of capital you are willing to lose on any single trade (e.g., 0.5% to 2% per trade). For example, if you buy a stock at ₹1000 and set a 1% stop-loss, your stop-loss order will be placed at ₹990.

- Support and Resistance Levels: These are crucial technical levels where a stock’s price tends to find buying or selling pressure. When buying (long position), place your stop-loss slightly below a key support level or a recent swing low. If the stock breaks below this level, it signals further downside potential. Conversely, when selling (short position), set your stop-loss slightly above a key resistance level or a recent swing high.

- Moving Average Method: Intraday traders can use shorter-period Moving Averages (e.g., 9-period or 20-period Exponential Moving Averages – EMAs) as dynamic support or resistance. When you buy, set your stop-loss slightly below the moving average line. If the stock falls below the moving average, it might indicate a trend reversal.

- Trailing Stop-Loss: This is a dynamic stop-loss that moves with the price, allowing you to lock in profits as the stock moves in your favor while still limiting downside risk. For example, if you buy a stock at ₹100 and set a ₹5 trailing stop-loss (initial stop-loss at ₹95), and the stock rises to ₹110, your trailing stop-loss automatically moves up to ₹105. If the stock then falls from ₹110, your profit is protected if it hits ₹105.

Common Mistakes to Avoid:

- Setting Stop-Loss Too Close: Placing it too near the entry price can lead to being “stopped out” by minor market volatility or “stop hunting” by large players.

- Not Adjusting Stop-Loss: Market conditions change. Adjust your stop-loss as the trade progresses or the market trend shifts.

- Emotionally Removing Stop-Loss: This is the most dangerous mistake. Once your stop-loss is hit, accept the loss and exit the trade. Don’t let emotions drive you to hold on to a losing position, violating a core unwritten rule of share market discipline.

- No Pre-determined Stop-Loss: Always define your stop-loss level before entering a trade.

Beyond Charts & Numbers: The Stock Market Hidden Rules of Mental Resilience

Success in the share market isn’t just about strategy and analysis; it’s also a significant test of your mental fortitude. Until you understand the workings of your own mind, no chart or analysis can truly save you. Overlooking this aspect can lead to mental exhaustion in the stock market. In today’s era of algo trading, many young individuals are experiencing mental stress related to the market. If you want to trade in the market free from FOMO (Fear Of Missing Out), fear, and greed, then consider this:

For a deeper dive into managing emotional setbacks and practicing mental detox after trading losses, refer to this comprehensive resource: Trading Loss Mental Detox Guide

. These insights are crucial for navigating the stock market hidden rules of psychological influence.

Read Also: Stock Market Investing with Small Budget in India (₹500-₹1000)

Embracing the Unwritten Rules of Share Market for Smarter Investing

The unwritten rules of share market are not found in textbooks but are learned through observation, experience, and disciplined practice. Understanding circuit filters, deciphering the actions of FIIs and DIIs, and mastering the art of setting stop-loss are crucial for any investor, especially in the dynamic Indian market. These principles, often considered stock market hidden rules, differentiate successful investors.

By acknowledging these subtle yet powerful dynamics, investors can move beyond basic analysis. They can make more informed decisions, manage risks more effectively, and cultivate the mental resilience needed to thrive in the long run. Embrace these unwritten rules of share market to transform your approach from simply trading to truly investing with wisdom.

1 thought on “Unwritten Rules of Share Market: Insights for Indian Investors”