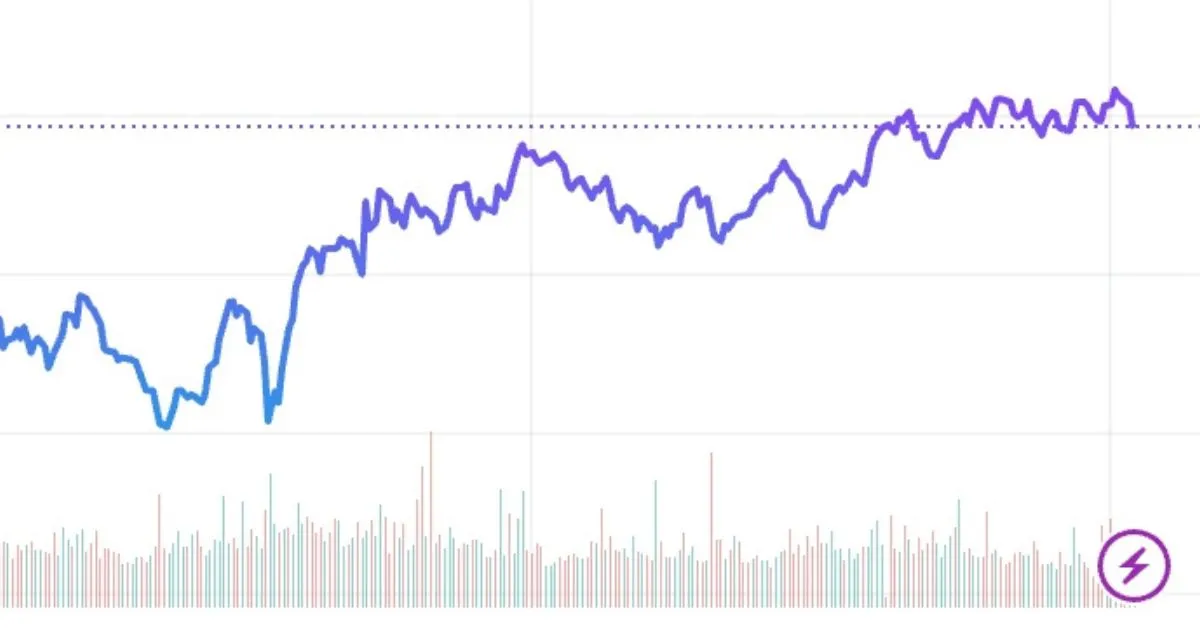

A sharp sell-off wiped out nearly ₹8 lakh crore from investor wealth in a single session as benchmarks tumbled deeply.

The Sensex Nifty plunge reflected growing anxiety over escalating trade tensions with the United States, triggered by fresh developments on potential tariff hikes.

On Thursday, January 8, 2026, the BSE Sensex closed 780 points lower at 84,181, while the NSE Nifty shed 264 points to end at 25,877, marking the fourth straight day of losses.

Sensex Nifty Plunge: Heavy Selling in Final Hours

Trading opened on a weak note, with indices attempting a mild recovery in the early hours. However, intensified selling pressure in the afternoon, particularly in metal, oil & gas, and banking stocks, dragged the market lower.

The broader sell-off erased gains from recent sessions, pushing market capitalization on BSE down significantly in one day.

Trump Tariff Threat Triggers Market Jitters

The primary trigger for the downturn was reports of US President Donald Trump backing a bipartisan sanctions bill that could impose tariffs as high as 500% on countries continuing to purchase Russian oil.

This legislation, known as the Sanctioning Russia Act of 2025, aims to pressure nations like India, China, and Brazil by targeting their imports to the US. India, a major buyer of discounted Russian crude despite previous sanctions, has seen its imports decline recently but remains in focus.

Earlier tariffs of up to 50% were already in place on certain Indian goods linked to this issue, and the new threat heightened uncertainty over bilateral trade relations.

Sectoral Impact and Investor Losses

Metal and oil-related stocks bore the brunt, reflecting direct exposure to energy trade dynamics. Banking shares also contributed to the drag amid broader risk aversion.

The steep fall led to a massive erosion in wealth, with around ₹8 lakh crore vanishing from BSE-listed companies in the session.

Stay informed on evolving trade policies, market reactions, and expert analyses for the latest developments in equities.

Disclaimer: This article is based on market data, exchange reports, and news sources as of January 8, 2026. Stock markets are volatile and subject to risks; figures are approximate. Readers should verify with official sources and consult financial advisors for investment decisions.