Sensex Nifty Closing December 18 2025: Volatile Session Ends With Benchmarks Almost Unchanged

The Indian stock market opened on a weak note today, December 18, 2025, slipping in early trade amid cautious global signals.

However, buying in select heavyweights helped recover much of the losses, leading to a near-flat close despite intraday swings.

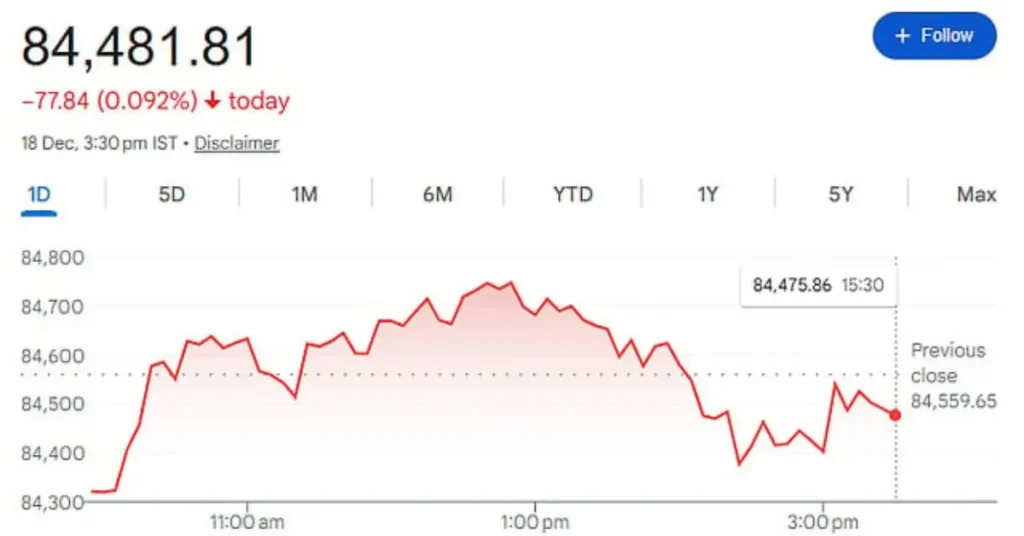

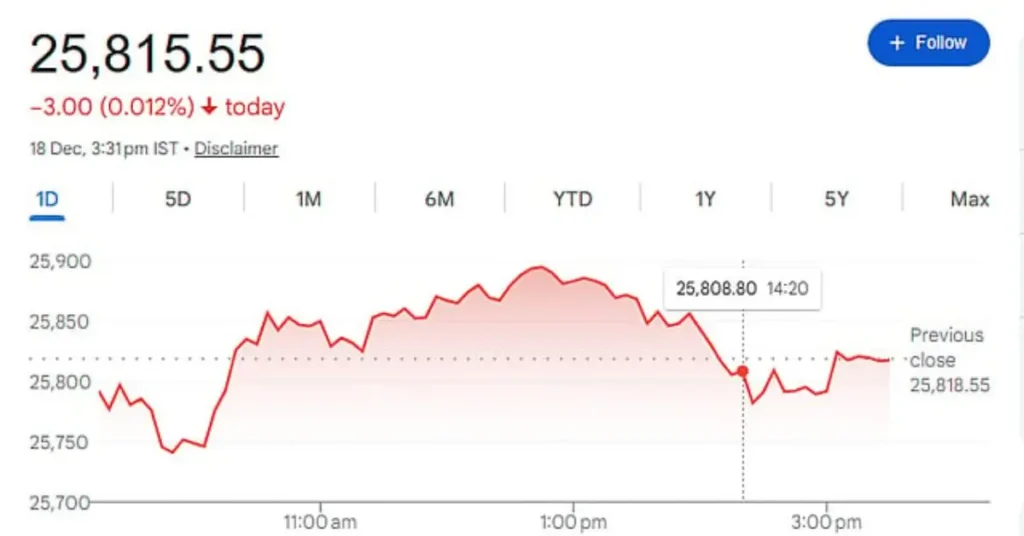

Market Closing: Sensex and Nifty Performance

The BSE Sensex closed down 78 points at 84,482 levels after touching a low of around 84,238 during the session. The NSE Nifty ended with a minor drop of just 3 points at 25,816, holding firmly above the key 25,800 mark. Market breadth remained weak, with more stocks declining than advancing on both exchanges.

Sectoral Performance: IT Outshines, Auto and Pharma Drag

The IT sector emerged as the standout performer, gaining around 1.2% led by heavyweights like TCS and Infosys. On the other hand, auto, pharma, and energy stocks faced selling pressure. The Nifty Midcap index managed modest gains, showing relative strength with a bullish pattern near its 50-day EMA.

Top Gainers and Losers

Top Gainers

- IndiGo: +2.71% (₹5,115.50)

- TCS: +1.96% (₹3,280.80)

- Max Healthcare: +1.69% (₹1,048.50)

- Tech Mahindra: +1.66% (₹1,605.60)

- Infosys: +1.55% (₹1,626.80)

Top Losers

- Sun Pharma: -2.62% (₹1,745.90)

- Tata Steel: -1.30% (₹168.12)

- Power Grid: -1.21% (₹257.95)

- Asian Paints: -0.93% (₹2,759.70)

- NTPC: -0.86% (₹318.50)

Global Market Cues: Mixed Signals

Global markets showed mixed trends. European indices extended their gains modestly, while Asian peers like Kospi and Nikkei ended lower. US markets from the previous session were also uneven, influencing sentiment here.

FII and DII Activity: Domestic Institutions Provide Support

On December 17, foreign institutional investors (FIIs) net sold shares worth ₹1,172 crore, while domestic institutional investors (DIIs) bought ₹769 crore. So far in December, FIIs have offloaded over ₹22,000 crore, but strong DII buying of more than ₹43,000 crore has cushioned the market.

Technical Outlook for Sensex Nifty Closing December 18 2025

Technically, the converging 20-day and 50-day EMAs suggest a potential breakout soon. Key support lies in the 25,750-25,700 zone, aligning with the 50-day EMA. A breach here could invite more selling. Resistance is seen at 25,930 and the psychological 26,000 level. Derivatives data pointed to long unwinding rather than fresh short positions.

The market continues to navigate volatility with sectoral rotation in play. Keep an eye on global developments and institutional flows for the next trading session.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Stock markets are subject to risks; consult a qualified advisor before making any investment decisions.