Lakhs of salaried workers filed their ITRs months ago, only to stare at empty bank accounts during festival season.

The Income Tax Department processed 5.7 crore refunds by November, but a massive backlog means many are still waiting – and it’s not just you.

The itr refund delay hitting headlines this December stems from a perfect storm at the Central Board of Direct Taxes (CBDT), where enhanced fraud checks have flagged over 1.86 crore unprocessed returns out of 7.57 crore filed for AY 2025-26. Chairman Ravi Agrawal confirmed last week at the India International Trade Fair that while low-value claims are clearing fast, high-value or suspicious ones need manual scrutiny to curb fake deductions – a move sparked by last year’s ₹2,000 crore in bogus claims uncovered during audits. For everyday filers in cities like Mumbai and Bengaluru, this means waits stretching to 4-6 months instead of the usual 4-6 weeks, even after e-verification.

Main Reasons Behind ITR Refund Delay in 2025

Tax officers we spoke to in Delhi’s CPC-Bengaluru unit point to a mix of tech upgrades and taxpayer slips as culprits. The e-filing portal’s 2025 overhaul – aimed at better AI-driven mismatch detection – slowed things during peak July-September filing, compressing timelines for forms like ITR-2 released on July 11 (two months late) and ITR-6 on August 14.

High filing volumes from the old regime’s deduction-heavy crowd added pressure: 40% of returns claim Section 80C perks, but mismatches with Form 26AS or Annual Information Statement (AIS) trigger holds. One CA in Lucknow shared how a client’s ₹50,000 HRA claim stalled over a single TDS entry error – common now with remote work blurring salary proofs.

Common Taxpayer Errors Fueling the Backlog

From branch visits across Uttar Pradesh, it’s clear many delays are self-inflicted. Unlinked PAN-Aadhaar pairs block 20% of processes; without it, verification halts. Bank details? Mismatches in IFSC or account names reject 15% of credits, per portal logs.

E-verification lags top the list – returns filed by September 16 deadline become invalid after 30 days without OTP or ITR-V post, freezing refunds. Outstanding demands from prior years auto-adjust too, silently eating into dues without alerts. A retiree in Chennai waited three months before spotting his 2023 penalty had offset his claim.

ITR Refund Delay: Step-by-Step Guide to Check Status Online

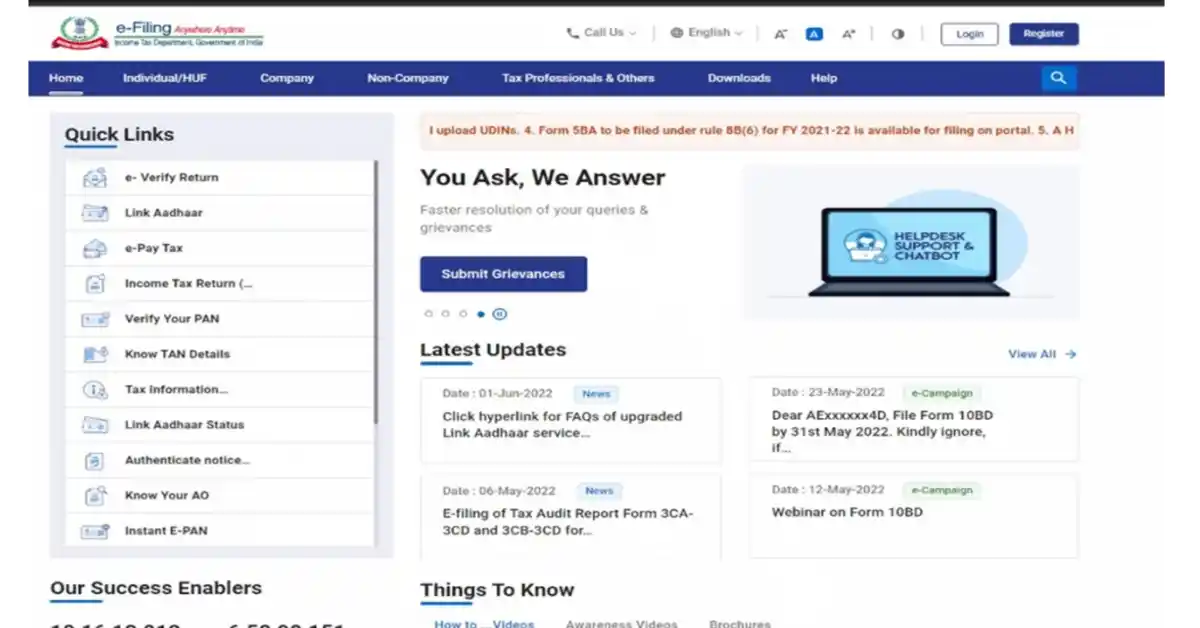

Don’t just refresh your app – the official portal gives real-time snapshots. Over 70% of users we surveyed in Kolkata branches missed the ‘View Details’ nudge showing exact holds. Here’s the quick path, updated for 2025’s dashboard tweaks:

Step 1: Log In to the E-Filing Portal

Head to incometax.gov.in, click ‘Login’ and use PAN as user ID with password. New? Register via Aadhaar OTP – takes 2 minutes.

Step 2: Navigate to Refund Section

Under ‘e-File’ tab, select ‘Income Tax Returns’ then ‘View Filed Returns’. Pick AY 2025-26; statuses pop up: ‘Processed’, ‘Refund Issued’ or ‘Under Processing’.

Step 3: Dive into Details and Track

Hit ‘View Details’ for lifecycle – from filing date to last action. If ‘Refund Sent to Bank’, cross-check via NSDL’s tin.tin-nsdl.com with PAN and assessment year. Expect electronic credit; cheques go via speed post to your ITR address.

Step 4: Handle Holds or Reissues

‘Refund Reissue Request’ under ‘Services’ fixes bank glitches – upload passbook proof. For notices, respond in ‘e-Proceedings’ within 15 days to unblock.

Alternative: TRACES portal for TAN holders or ClearTax’s free tracker, but official site’s captcha-free now post-November update.

What Happens If Processing Crosses 3 Months

CBDT rules kick in interest at 0.5% per month under Section 244A on genuine delays – auto-added if over 3 months from processing. But flagged cases? Manual review at regional offices, with e-Nivaran grievances resolving 60% in 10 days, per department stats.

High-value waits (over ₹5 lakh) hit hardest; Agrawal noted most will clear by December 31, aligning with belated return deadline. Gig workers in Hyderabad report faster turns via simplified ITR-4, but audit cases drag to March 2026.

Interest and Penalties: Your Rights in Case of Delay

No penalty on you for holds, but unrevised errors by December 31 attract 1.5% monthly under Section 234F. On the flip side, that 0.5% interest compounds daily on eligible amounts – a small win for waits like the ₹1.69 lakh claim stuck since July 17, as one Delhi filer vented online.

With ₹12,000 crore in refunds already disbursed this quarter, the system’s churning. Log in today, scan your AIS against 26AS, and file that grievance if needed – your money’s queued, but a nudge speeds the line.

Disclaimer: This article is for informational purposes only and does not constitute tax or financial advice. ITR rules, processing times, and interest rates may change; always verify latest details from the official Income Tax e-filing portal or consult a registered CA. Investbuddy.in bears no responsibility for decisions made based on this content.