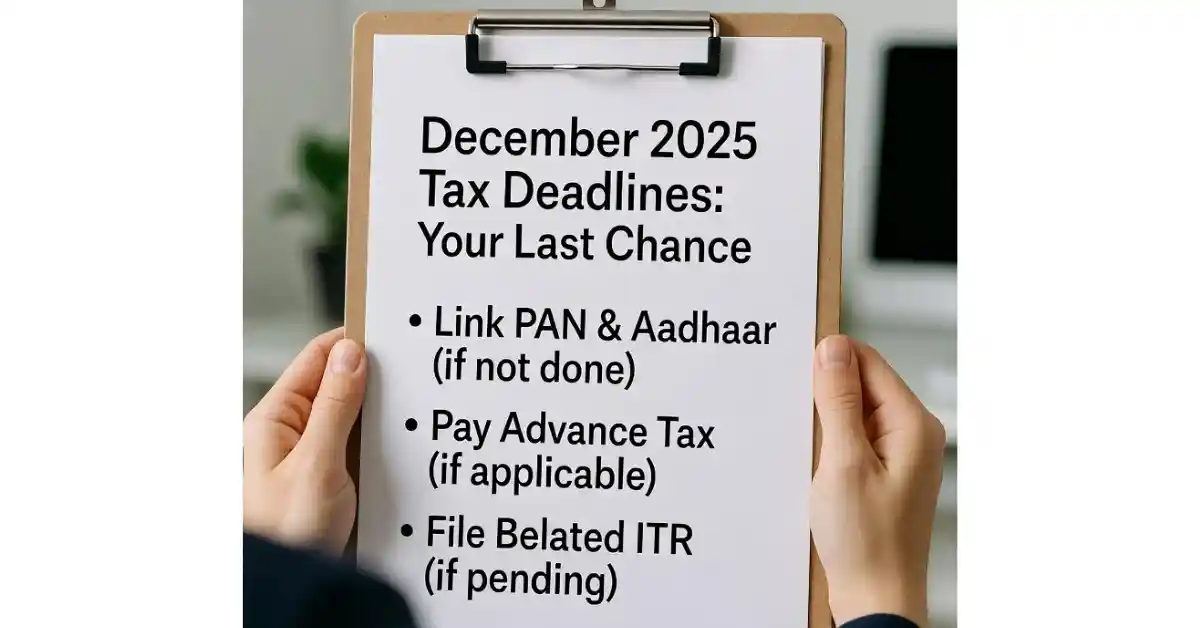

The clock is ticking on the final month of 2025. For millions of Indian taxpayers, December 2025 tax deadlines represent a critical window to complete mandatory financial compliance tasks or face significant penalties and disruptions. With key due dates for advance tax, PAN-Aadhaar linking, and belated income tax returns all falling within the next 31 days, overlooking these obligations can lead to a frozen PAN, higher tax outgo, and legal hassles. The Income Tax Department has set a firm calendar, and this month marks the absolute last chance for several actions for the current financial year.

Critical December 2025 Tax Deadlines You Must Know

Failing to act before these dates will transition a routine compliance task into a problem requiring resolution with extra fees and potential legal notices.Here are the four non-negotiable deadlines set by the tax authorities.

- Tax Audit Report Filing: Final Date is December 10

For taxpayers whose accounts are subject to a tax audit under the Income Tax Act,the due date to file the audit report in Form 3CA/3CB/3CD along with the requisite Income Tax Return (ITR) is December 10, 2025. This applies typically to businesses and professionals whose turnover or gross receipts exceed specified limits.

· Consequence of Delay: Filing the return after this date will be treated as a default. It will not be considered a belated return but a delayed one, potentially attracting interest under Section 234A from the original due date of the return.

- Advance Tax Final Instalment: Due by December 15

The third and crucial instalment ofadvance tax for the financial year 2025-26 is payable on or before December 15, 2025. This is mandatory for all taxpayers—including salaried individuals with substantial other income, freelancers, and business owners—whose estimated total annual tax liability, after deducting Tax Deducted at Source (TDS), exceeds ₹10,000.

· Consequence of Non-Payment: If you miss this payment, you will be liable to pay interest for deferring the tax payment. Interest under Sections 234B and 234C of the Income Tax Act will be levied on the unpaid amount from the due date until the date of actual payment.

- Belated/Updated ITR for FY 2024-25: Last Date December 31

If you missed the original July 31,2025, deadline for filing your ITR for the financial year 2024-25 (Assessment Year 2025-26), December 31 is your final opportunity to file a belated or updated return.

· Late Fee Structure:

· ₹1,000 if your total income is up to ₹5 lakh.

· ₹5,000 if your total income exceeds ₹5 lakh.

· Critical Loss: Beyond this date, you permanently lose the right to carry forward certain losses (like from house property or capital assets) to set off against future income.

- PAN-Aadhaar Linking: Mandatory by December 31

This is arguably the most pressingDecember 2025 tax deadline for the general public. If your PAN was issued using an Aadhaar enrollment ID (and not the actual Aadhaar number) on or before October 1, 2024, linking the two is mandatory by December 31, 2025.

· Consequence of Not Linking: Your Permanent Account Number (PAN) will become inoperative from January 1, 2026. This is not a minor inconvenience; it has severe implications:

· Higher TDS/TCS rates will be deducted on your income.

· You cannot file your ITR.

· All pending tax refunds will be withheld.

· Routine financial activities like opening a new bank account, investing in mutual funds, or trading in securities will be blocked.

· How to Link: Visit the Income Tax e-Filing portal, navigate to the “Link Aadhaar” option under ‘Quick Links’, and enter your PAN, Aadhaar number, and name as per Aadhaar. Authorize using the OTP sent to your registered mobile.

Act Now to Avoid the Year-End Compliance Rush

The last week of December typically sees a massive surge in traffic on the e-filing portal,leading to potential technical glitches and delays. Procrastination is not an option this month. The consequences of missing these December 2025 tax deadlines are concrete and financially detrimental—from a deactivated PAN that cripples your financial identity to mandatory interest payments that increase your tax burden. Whether it’s the advance tax calculation, the quick online PAN-Aadhaar linking, or filing a belated return with a late fee, the time to act is now. Mark these dates, complete the tasks, and step into the new year without the burden of pending tax compliance.